Wall-to-Wall Fintech Content to Educate and Inspire

The future of financial technology is being redefined by dramatic trends in banking, how payments are being made and new players including healthcare and gaming. Consumers and businesses alike are demanding environmental, social and corporate governance to address major issues of today to make sure everyone has access to and benefits from our financial systems, that we are managing our resources for future generations, and basic human rights are recognized to provide everyone with opportunities for prosperity. We live in a dynamic world and there are dramatic trends that will revolutionize, forever change, fintech including metaverse, gaming, authentic identification and cybersecurity.

This year’s theme is Reliability | Innovation | Transparency. Fintech South 2023 will feature 100+ top-tier speakers representing the top companies in fintech globally, all providing insights on the most important trends and how to thrive. The action takes place across the Fintech South Mainstage and Deep Dive Track Sessions. 2023 Topics include:

|

|

|

Agenda

For the most up-to-date detailed agenda, please use the Fintech South App.

Scan the QR code to download, or click here.

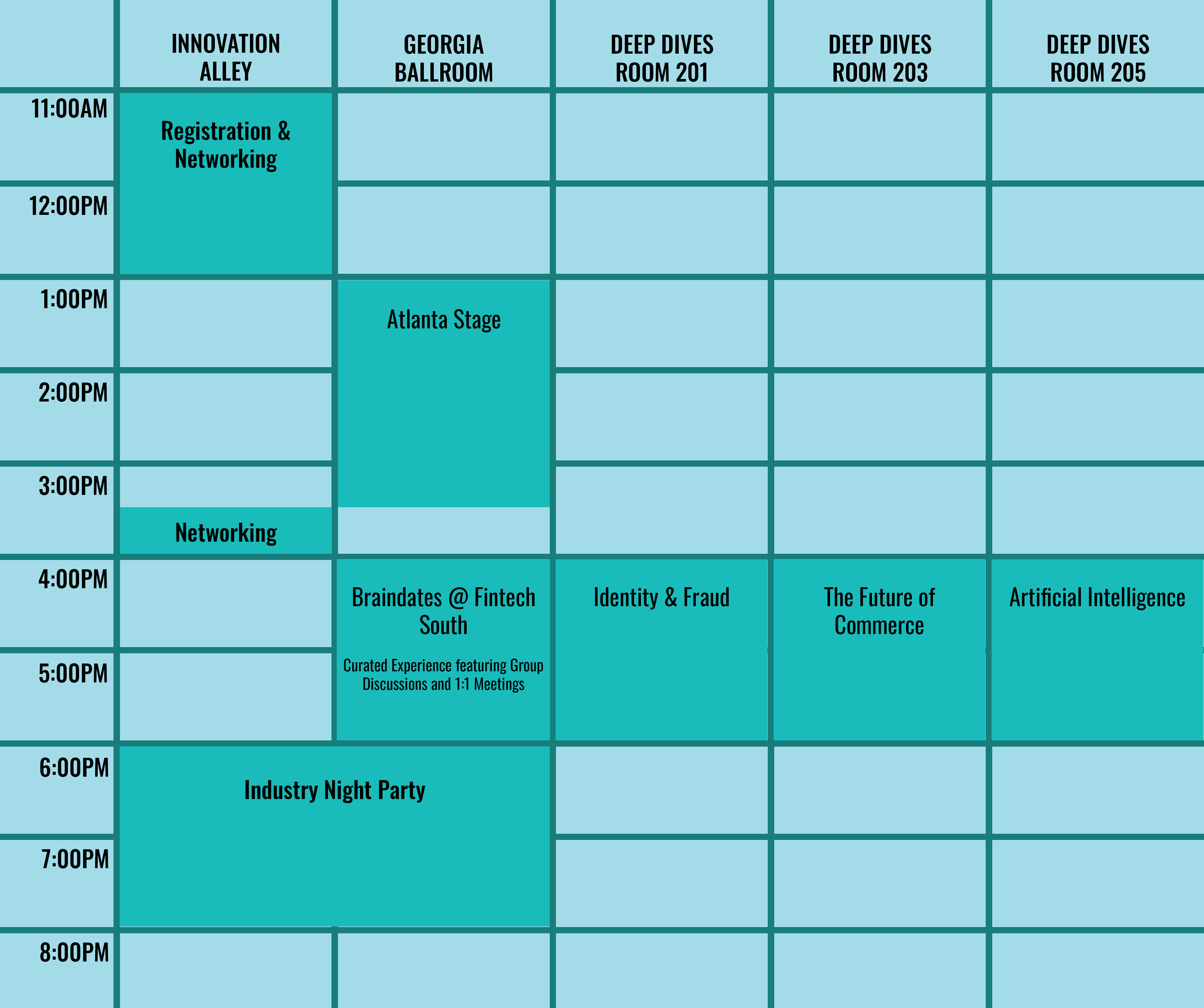

Tuesday, September 12

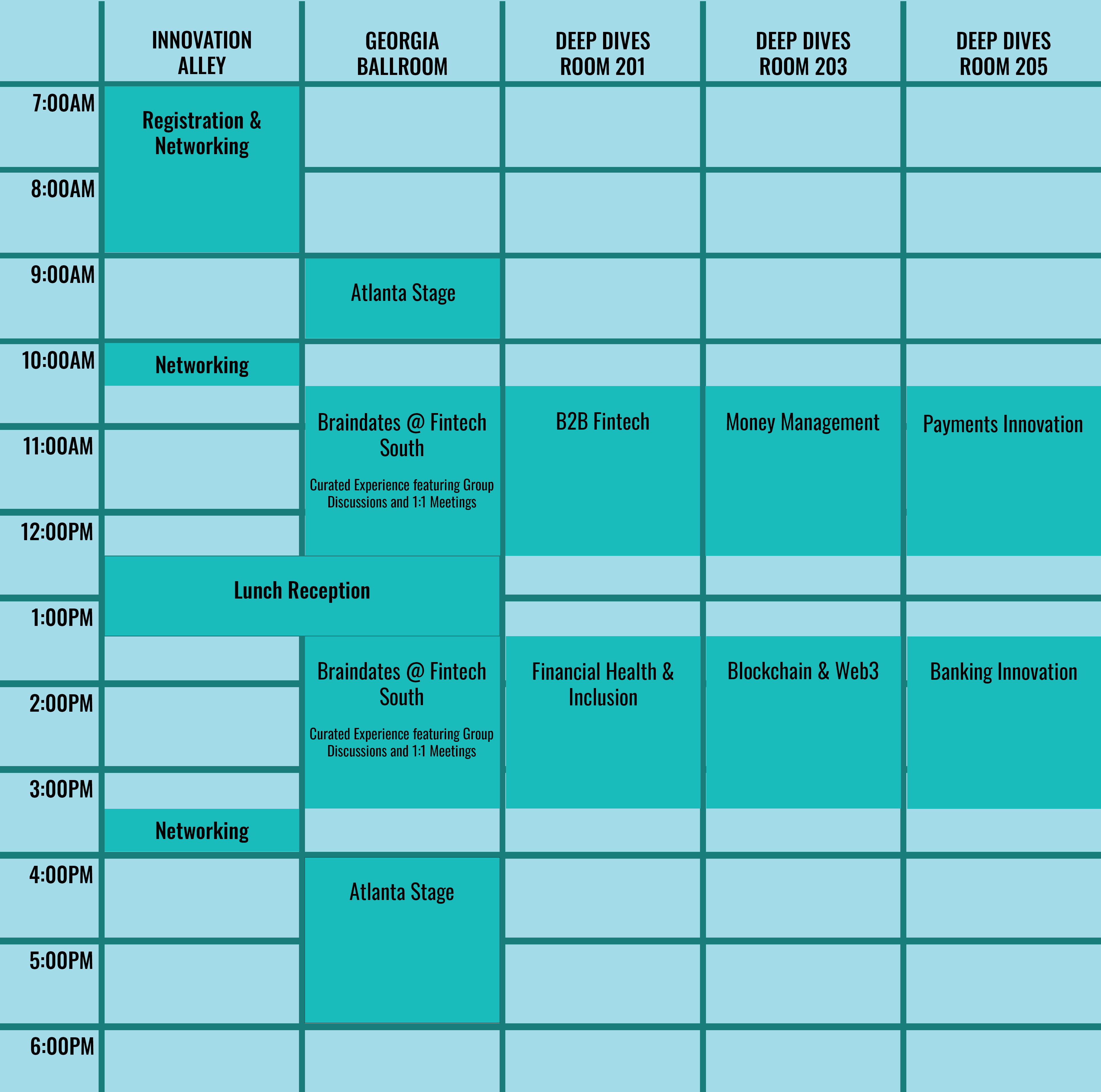

Wednesday, September 13

Fintech South is a place to Engage, Connect, Interact, and Learn

2023 Featured Speakers

Featuring

Stacey Abrams

Fintech Investor & Entrepeneur; New York Times Bestselling Author; Co-Founder

Now®

Lara Hodgson

Co-Founder, President & CEO

Now®

Lynne Laube

2021 Georgia Fintech Hall of Fame Inductee; Co-Founder, Cardlytics; Partner

Valor Ventures

Marcilio Oliveira

Co-founder & Chief of Growth

Sensedia

Robert Park

Co-founder & Chief Technology Officer

IEX Group, Inc.

Michael Reed

Senior Vice President, Division President Payments

Deluxe

Scott Sandland

Co-Founder & CEO

Cyrano.ai

Jeff Sloan

Global Payments; Board Member, Private Equity and Venture Capital Investor; Retired CEO

Global Payments

Mainstage sessions featuring the best in fintech from around the globe.

Innovation Challenge

Innovation Challenge is an annual program that recognizes innovative U.S. fintech startups with ties to Georgia. Eligibility for the program, which includes both cash and in-kind awards for the winning company, is limited to founders of early-stage companies who have raised less than $1.5 million in funding and are based in (or committed to relocating to) Georgia. Learn more here.

ADVANCE Awards

The TAG Fintech ADVANCE award program recognizes innovative U.S. fintech companies with ties to Georgia. Click here for more information.

Innovation Alley

Braindates @ Fintech South

Dedicated time for meetings, each day of Fintech South.

One of the most important aspects of events is engaging with other industry stakeholders to learn, grow your business, and advance your career – but we know your time is valuable and you need to make the most of it. That’s why we’re partnering with Braindate for a powerful new curated meetings program at Fintech South 2023!

What is a braindate?

It is your opportunity to learn from your peers and make the right connections! Braindates are one-on-one or small group conversations based on topics posted by you and fellow participants in the Braindate Topic Market. They can be used to brainstorm, solve challenges, share expertise or experiences while meeting new (brilliant!) people.

Don’t see what you’re looking for? Then post a topic yourself and invite others join a group discussion where you are the host. Haven’t signed up yet? Need some help getting engaged? Then stop by the Braindate check-in desk located just outside the Georgia Ballroom on Level 2 and our expert team will guide you each step of the way.

Here’s what to do:

- Log in to the TAG Events App to book your braindates as soon as the Braindate platform is launched in September.

- Once Fintech South begins, you’ll connect with your braindates on-site in the Braindate Lounge. Our Learning Concierges will be available to assist you in the Lounge!

Learn more about networking at Fintech South HERE

Deep Dive Track Sessions

Click the icons for details about each track.

Artificial Intelligence

Featuring

Marva Bailer

Vice President

Globality

Dorothea Bozicolona-Volpe

Principal

Social Espionage

Demi Knight Clark

Head, Strategy & Biz Dev

TidalWave

Yogs Jayaprakasam

SVP, Chief Technology and Digital Officer

Deluxe

Jethro Lloyd

CEO

iLAB

Siraj Alimohamed

Director - Data & AI

Experion Technologies

Dr. Mark Moyou

Senior Data Scientist

NVIDIA

John Ripma

Founder, Technical Ink, LLC; Senior Consultant

Experion Technologies

Kareem Saleh

Founder & CEO

Fairplay AI

Erin Schilling

Digital Editor

Atlanta Business Chronicle

Pradeep Vancheeswaran

Global Head - BFSI

Experion Technologies

Bill VanCuren

President

BVC Advisors

Sponsored by

From ChatGPT to Roboadvice: How AI is Transforming Financial Services

Tuesday, September 12

Room 205

The Rise of AI in Fighting Financial Crime

- Siraj Ali Mohamed, Experion Technologies

- Sudhir Nair, AmeriSave Mortgage; loanDepot

- Pradeep Vancheeswaran, Experion Technologies

Intelligent Automation in Financial Services: New Efficiencies and Workforce Realities

- Jethro Lloyd, iLAB

- Yogaraj (Yogs) Jayaprakasam, Deluxe

- Demi Knight Clark, Tidalwave.ai

- Dr. Mark Moyou, NVIDIA

Real-World Impact of Generative AI: Bend the Productivity and Savings Curve by Optimizing Company Spending

- Bill VanCurren, NCR Corporation; BVC Advisors LLC

- Marva Bailer, Globality

Scaling Fairness-as-a-Service: How to Reduce Algorithmic Bias in Financial AI

- Kareem Saleh, FairPlay AI

- Erin Schilling, Atlanta Business Chronicle

B2B Fintech

Featuring

Guy Berg

VP Payments, Standards & Outreach Group

Federal Reserve Bank of Minneapolis

Timara Frassrand

VP of Strategic Partnerships

Transcard

Robin Gregg

CEO

RoadSync

Lizzie Guynn

Partner

TTV Capital

Ernie Martin

Board Member, Digital Business Network Alliance; Founder & CEO

Receivable Savvy

Mike Neumeier

CEO

Arketi Group

Joshua Silver

Founder & CEO

Rainforest

Aleksandra Teichman

Head of Acquiring, BD and Strategy

Cross River

B2B Fintech: The Unsung Heroes Powering Next-Gen Financial Solutions

Wednesday, September 13

Room 201

Modernizing Business-to-Business Payments Through Enhanced interoperability & Connectivity

- Ernie Martin, Digital Business Network Alliance; Receivable Savvy

- Guy Berg, Federal Reserve Bank of Minneapolis

The Coming Revolution in Embedded Payments

- Robin Gregg, RoadSync

- Joshua Silver, Rainforest

- Aleksandra Teichman, Cross River

- De’Havia Stewart, Serena Ventures

- Lizzie Guynn, TTV Capital

Scaling a Fintech Business

- Stephen Walsh, Keeper Solutions

- Maria Gagic, Enterprise Ireland

Banking Innovation

Featuring

Aloke Agarwal

Director, Industry Cloud for Banking Product Owner

PwC

Natalia Cruz

Head of Open Finance

Sensedia

Stephanie Foster

Managing Director, ThinkTECH Accelerator

ICBA

Brandon Horne

GM Strategic Partnerships

Greenlight

John Jenkins

Founder/Fintech Consultant

Overseas Technology Consulting Corp

Lane Martin

Principal

PwC

Julie Offen

Executive Director

JP Morgan Payments

Marcilio Oliveira

Co-founder & Chief of Growth

Sensedia

Matt Pierce

Founder & CEO

Immediate

Steven Riddick

VP, Client Success

Visa

Christina Bechhold Russ

Head of Strategic Investment Initiatives, Truist Ventures

Truist

Kattia Sigui

Chief Operating Officer

Maast

Filipe Torqueto

Head of US Solutions Architect

Sensedia

Sponsored by

Open Banking & Finance: Data Sharing, Innovation & Access

Wednesday, September 13

Room 205

Nothing Immediate About Getting the Greenlight: Two Fintechs’ Journeys to Bank Partnerships

- Brandon Horne, Greenlight

- Julie Offen, JPMorgan Chase

- Matt Pierce, Immediate

- Christina Bechhold Russ, Truist

- Stephanie Foster, Independent Community Bankers of America (ICBA)

Accelerating Digital Transformation in Banking: What Leading FIs Are Doing to Keep Pace and Harness the Latest Technologies

- Aloke Agarwal, PwC

- Steven Q. Riddick, Visa

- John Jenkins, Western Alliance Bank

- Lane Martin, PwC

- Kattia Sigui, Maast

Why “Open” is Not a 4-Letter Word in Banking: What Banks in the U.S. Can Learn from the Rest of the World

- Eduardo Goni de Oliveira, Rendimento/pay

- Filipe Torqueto, Sensedia

- Natalia Cruz, Sensedia

Blockchain & Web3

Featuring

Nicholas Baes

Head of Software Engineering - Crypto

Bakkt

Shannon Diesch

CEO

Quarter

Zenobia Godschalk

Founder, ZAG Communications; SVP Communications

Swirlds Labs, growing the Hedera ecosystem

JoAnn Holmes

Founder

Holmes@Law

Gregory Johnson

Co-Founder & CEO, Rubicon Crypto; Professor, New York University

Rubicon Crypto

Sandeep Kaur

Director of BFS DLT Solutions

Innova Solutions

Mina Khattak

Senior Director, Crypto & Web3

Worldpay

Digital Assets, DeFi & Web3: Why the Future of Financial Services Is Still Powered by Blockchain

Wednesday, September 13

Room 203

DLT is Transforming the Financial Services Industry: Where Are You Going?

- Sandeep Kaur, Innova Solutions

How One of the World’s Largest Payments Companies is Working to Bring DeFi to the Masses

- Mina Khattak, Worldpay at FIS

- Zenobia Godschalk, ZAG Communications; Hedera Hashgraph

Tokenized Economies: Use Cases for Digitization of Real World Assets

- Nicholas Baes, Bakkt

- JoAnn Holmes, HOLMES@LAW, LLC

- Shannon Diesch, Quarter

- Zenobia Godschalk, ZAG Communications; Hedera Hashgraph

Financial Health & Inclusion

Featuring

Tal Clark

CEO

Instant Financial

Kim Ford

SVP, Government Relations

Fiserv

Jessica Kemp

SVP, Product & Marketing

Highline

Michael Lewandowski

Principal, FS Lead

Method

Gregg O’Neill

Chief Revenue Officer

in/PACT

Alexandra Raymond

Finance Product Manager

Amazon Studios

Brian Tate

President & CEO

Innovative Payments Association

Mary York

Chief Executive Officer

York Public Relations

Sponsored by

Inclusive Fintech: Closing the Gaps, Serving the Underserved

Wednesday, September 13

Room 201

Fintech Goes to Work: Powering Financial Health in the Workplace

- Tal Clark , Instant Financial

- Kim Ford, Fiserv

- Jessica Kemp, Highline

- Brian Tate, Innovative Payments Association

Inclusion As An Innovation Strategy: Boosting Profitability Through Inclusive Design

- Alexandra Raymond, Amazon Studios

Doing Well By Doing Good: Where Impact Meets Opportunity for Financial Institutions

- Gregg O’Neill, in/PACT

- Michael Lewandowski, Method

The Future of Commerce

Featuring

Sebastian Builes

Co-Founder and CEO

Arcum

Jay Clarke

Director of Operations

Southern Proper Hospitality Group

Maija Ehlinger

Editor-in-Chief

Hypepotamus

Will Graylin

Founder, Chairman & CEO

OV Loop

Barclay Keith

CEO & Co-Founder

Momnt

Melissa Schmidt

SVP, Head of Sales and Marketing, Buy Now Pay Later | POS Lending

US Bank

Nandan Sheth

CEO

Splitit

Caroline Ward

US Sales Manager

sunday

Sponsored by

The Future of Commerce: Fintech for Where, When, and How People Will Shop Tomorrow

Tuesday, September 12

Room 203

Serving Up Fintech: A Prominent Atlanta Restauranteur’s Perspective On How Seamless Payments Drive Customer Loyalty

- Caroline Ward, sunday

- Jay Clarke, Southern Proper Hospitality Group

AI-Powered Personalization for Proactive Customer Retention

- Sebastian Builes – 2022 Innovation Challenge Winner; Arcum

Getting in the Loop for Seamless Commerce: Building a Community Empowered Super-App

- Will Wang Graylin, OV Loop

- Maija Ehlinger, Hypepotamus

Putting Customers’ Needs First: What’s Next for Buy Now Pay Later & Real-Time Lending?

- Barclay Keith, Momnt

- Nandan Sheth, Splitit

- Melissa Schmidt, Elavon

Identity & Fraud

Featuring

Michael Breslin

Partner, Kilpatrick Townsend & Stockton; General Counsel

Kilpatrick Townsend & Stockton

Mark Burnside

Director, Financial Services

FORVIS

Scott Harkey

Global Head of Marketing and EVP of Financial Services & Payments

Endava

Yuelin Li

Chief Product Officer

Onfido

Jennifer Louis

End User Computing Specialist, Enterprise Southeast

Amazon Web Services

Vlad Loungenov

Founder and CEO

Mbanq

Joe Radest

Co-Founder and COO

FP Omni Technologies

White Hats, Black Hats: The Art and Science of Fighting Financial Crime

Tuesday, September 12

Room 201

Next Gen Regulatory Compliance for Digital Banks: What Happens When AI Meets Regulation?

- Vlad Lounegov, Mbanq

- Scott Harkey, Endava

How Fintech is Unlocking Growth in the Cannabis Industry: Transacting in a Compliant and Lawful Manner

- Michael Breslin, Kilpatrick Townsend & Stockton; FP Omni Technologies

- Joe Radest, Radest Ventures; FP Omni Technologies

The Power of Real Digital Identity: Putting Digital Trust at the Core of Every Customer Interaction

- Yuelin Li, Onfido

- Mark Burnside, FORVIS

Money Management

Featuring

Dara Albright

Host, Decent Millionaire Podcast; Founder

Dara Albright Media

Paula Grieco

Senior Vice President

Commonwealth

Eleni Delimpaltadaki Janis

Managing Partner & Chief Investment Officer

Equivico

Sabrina Lamb

Founder and CEO

Wekeza

Allyson Laurance

VP, Market Intelligence

Prudential Financial

Pedro Moura

CEO & Co-Founder

Flourish Fi

Sally Outlaw

Founder & CEO

Worthy Financial

Brandon Tepper

SVP & Global Head of Data

Nasdaq

The Evolution of Money Management: Growing, Protecting, and Sharing Wealth

Wednesday, September 13

Room 203

Changing the Relationship Between People and Money: How Fintech Can Influence Smart Financial Decisions

- Pedro Moura, Flourish FI

- Paula Grieco, Commonwealth

Nasdaq’s Global Head of Data On Enabling Global Investors to Build Generational Wealth By Unlocking Access to U.S. Markets

- Brandon Tepper, Nasdaq

Fairer Finance: Fintechs Providing Access for Underserved Investors and to Underserved Competitive Markets

- Eleni Delimpaltadaki Janis, Equivco

- Sabrina Lamb, WorldofMoney.org; Wekeza

- Sally Outlaw, Worthy Financial

- Dara Albright, Decent Millionaire Podcast; Dara Albright Media

Payments Innovation

Featuring

Daniel Baum

SVP, Head of Payments Product for FedNow

Federal Reserve Bank of Atlanta

Dondi Black

EVP & Chief Product Officer

TSYS, a Global Payments company

Hillery Champagne

Director

Fintech Atlanta

Dave Excell

Founder

Featurespace

Scott Grimes

Co-Founder & Chairman

Cardlytics

Audrey Hall

Chief Product Officer

Brightwell

Sven Hinrichsen

President & GM of AP Automation

Corpay, a FLEETCOR company

Elizabeth McQuerry

Partner

Glenbrook Partners

Michael Reed

Senior Vice President, Division President Payments

Deluxe

Crypto, Cross-border, Social & Real-time: The Next Chapter for Digital Payments

Wednesday, September 13

Room 205

Unlocking Growth by Sharing Payments Data: Opportunities and Guardrails

- Dondi Black, TSYS, a Global Payments company

- Dave Excell, Featurespace

- Scott Grimes, 2021 Georgia Fintech Hall of Fame Inductee; Cardlytics

The Need for Speed: The Launch of the FedNow Service and Industry Perspectives on the Impact of Instant Payments

- Daniel Baum, Federal Reserve Bank of Atlanta

- Audrey Hall, Brightwell

- Sven Hinrichsen, Corpay, a FLEETCOR company

- Michael Reed, Deluxe

- Elizabeth McQuerry, Glenbrook Partners